This is stuff we’ve been talking about for ages. And the British Library has gone ahead and done it.

Just another WordPress site

This is stuff we’ve been talking about for ages. And the British Library has gone ahead and done it. Related posts: Have you ever had a dream, Neo, that you were so sure was real? What if you were unable to wake from that dream? How would you know the difference between the dream world … Continue reading “Old Maps to 3D Worlds”

Following on from the announcement that Mapbox just secured $10M in Series A and conversations this morning with a NISP EIR, I am left wondering how Northern Ireland can justify selling Series A of the scale of £200K with a 10% fee return and equity stakes of up to 30%? Doesn’t that just end up … Continue reading “Equity Egality”

Following on from the announcement that Mapbox just secured $10M in Series A and conversations this morning with a NISP EIR, I am left wondering how Northern Ireland can justify selling Series A of the scale of £200K with a 10% fee return and equity stakes of up to 30%?

Doesn’t that just end up de-motivating the founders? Don’t you just end up with an institutional stakeholder who has difficulty following on especially when the expectation of the return on the fund is less than zero?

Doesn’t it push valuations down when our geography would indicate that to approach your Series B (which will be a year away) you will need to look beyond these shores and spend a chunk of your Series A funding that process (and not focusing on product)?

Doesn’t it mean the job of the CEO becomes the endless search for further capital and not the development and expression of the team vision? How much runway does £200K provide for a globally focused startup compared to $10M?

And what is the purpose of public backed funds? I would expect them to be tasked with the role of creating value-added startups who will be fit to employ others, equipped to challenge anyone and financed to play on a global stage? I would not expect term sheets that were predatory, equity stakes that were nausea inducing, valuations that were humbling and anti-founder clauses (including an insistence of a hostile board member) that caused founders to disengage from the process early.

The point of public-backed funds is not to get as much value for money as possible (in terms of startup equity and founder enmity) but to accelerate the development of these companies to some sort of exit, up to and including merger, acquisition or even IPO. Inadvertently we have incentivised exactly the wrong activity in our public venture funds. I would be curious to see if it happens again.

Related posts: Courses in @unity3d announced this week… 2016 Training Plan We want to do more. Unity 3D Training continues…

The ideal café for the rest of us would: Have something happening every lunchtime (Brown Bag Learning Lunch) Have tables big enough for two laptops and two cappuccinos. Sell fresh fruit and wholesome soups (with a reduced reliance on delicious tray bakes) Would have a massive whiteboard for whatever is on your mind. Would be … Continue reading “A café for the rest of us”

The ideal café for the rest of us would:

Have something happening every lunchtime (Brown Bag Learning Lunch)

Have tables big enough for two laptops and two cappuccinos.

Sell fresh fruit and wholesome soups (with a reduced reliance on delicious tray bakes)

Would have a massive whiteboard for whatever is on your mind.

Would be like Belfast Open Coffee very day and Le Procope every night.

Would have a glass booth at the back for a phone call.

Would provide power and wifi to cafe subscribers.

Would be open early and open late. Maybe not in that order.

Would be run by an independent barista team who wanted a committed customer base.

Would have a small stage in the corner for the busker of the week (who would also get a share of tips)

Would accept that shabby chic is very last year and wouldn’t be afraid of embracing long desks and benches

Would have standing desks with power and Ethernet sockets.

Could be booked for an event but never a closed event.

Because I’ve been out of circulation, I’m kinda forced to triage some stuff here. If you don’t find anything interesting from this list then you’re at the wrong blog anyway. This project turns prisoners into entrepreneurs. It boasts a cracking success rate on a small sample but it’s that sort of model that interests me. … Continue reading “A bit of linked-list triage.”

Because I’ve been out of circulation, I’m kinda forced to triage some stuff here. If you don’t find anything interesting from this list then you’re at the wrong blog anyway.

From Journalism.co.uk: Investigative news blog for Northern Ireland The Muckraker is to follow long-form digital journalism project Matter in publishing a digital magazine where each issue is a single in-depth feature. The Muckraker Report will publish a digital edition every three months, charging £3 per issue, with investigations covering government and the public sector in … Continue reading “A Bigger Fear Than Failure – @readmuck”

Investigative news blog for Northern Ireland The Muckraker is to follow long-form digital journalism project Matter in publishing a digital magazine where each issue is a single in-depth feature.

The Muckraker Report will publish a digital edition every three months, charging £3 per issue, with investigations covering government and the public sector in Northern Ireland.

The venture will be 100% reader-funded, not accepting adverts and not allowing editorial to conflict with the commercial desires of advertising.

From their own site:

I have a bigger fear than failing. I’m afraid that one day I’ll wake up and I’ll be too old and too exhausted to try and change the status quo, to start a magazine that says “Fuck you!” to power. Better to do it at 23 and fuck it up than to never do it at all.

They need to get a heap of subscribers over a 5 year period to keep the venture going but I’m asking that folk consider picking up a sub, charged pennies for quality investigative journalism in the province. they’ll be asking not only the questions that need asked but also the questions that we are often too ill-positioned or ill-informed to pose ourselves.

You can sign up to be notified. The content may inform, it may outrage and part of me hopes it does both.

From Kottke.org The rarest of these specialists, he says, is an authentic genius — a person capable of having seemingly good ideas not in general circulation. “A genius working alone,” he says, “is invariably ignored as a lunatic.” The second sort of specialist is a lot easier to find: a highly intelligent citizen in good … Continue reading “Essential ingredients for a Revolution”

From Kottke.org

The rarest of these specialists, he says, is an authentic genius — a person capable of having seemingly good ideas not in general circulation. “A genius working alone,” he says, “is invariably ignored as a lunatic.”The second sort of specialist is a lot easier to find: a highly intelligent citizen in good standing in his or her community, who understands and admires the fresh ideas of the genius, and who testifies that the genius is far from mad. “A person like this working alone,” says Slazinger, “can only yearn loud for changes, but fail to say what their shapes should be.”

The third sort of specialist is a person who can explain everything, no matter how complicated, to the satisfaction of most people, no matter how stupid or pigheaded they may be. “He will say almost anything in order to be interesting and exciting,” says Slazinger. “Working alone, depending solely on his own shallow ideas, he would be regarded as being as full of shit as a Christmas turkey.”

I know some of these people. And if they could be convinced to work together, it could change the face of our country. Chances are, you know some of them too.

For the last couple of years I’ve been listening to Denis Stewart talk about Civic Conversations. Last summer I got to take part in one (in Riddell Hall) and again earlier this year (in the Crescent Arts Centre). This time, it’s in the MAC. A further gathering of citizens in this place to continue with … Continue reading “More on Civic Conversations”

For the last couple of years I’ve been listening to Denis Stewart talk about Civic Conversations. Last summer I got to take part in one (in Riddell Hall) and again earlier this year (in the Crescent Arts Centre). This time, it’s in the MAC.

A further gathering of citizens in this place to continue with ‘civic conversation’ – conversation that is both aspirational and grounded, visionary and pragmatic.

This gathering will provide opportunity for open conversation. And there will also be time for more focused talking together about themes that emerged in from the civic conversation that took place in February. What should the next chapter in Northern Ireland’s story say? What can be done to help shape and write that ‘next story’?

To find out, you will have to come along but I’ll give you my perspectives.

These events are driven by the people who need to be there. People for whom being part of the architecture of the future of Northern Ireland is without question. People who know we must move forwards. If that describes you, I’m sure you’ll be there.

From here. Attending a cluster of clusters in digital. It’s quite interesting. Lots of really clever people. Related posts: London, City of the Future Digital Circle going independent and my thoughts on the Future We want to do more. Highlights: Neelie Kroes at the 2011 Digital Agenda Summit organised by the Lisbon Council

From here.

Attending a cluster of clusters in digital. It’s quite interesting. Lots of really clever people.

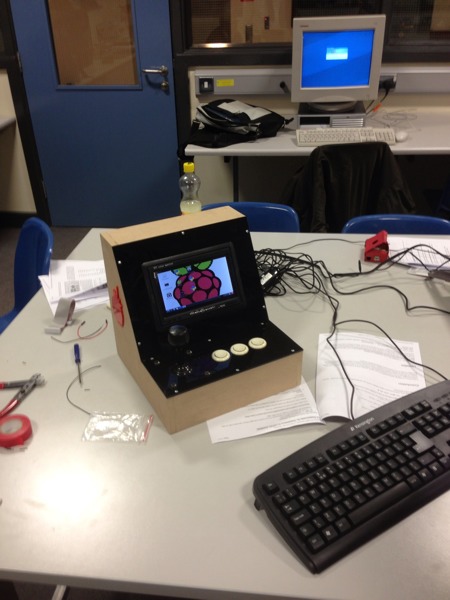

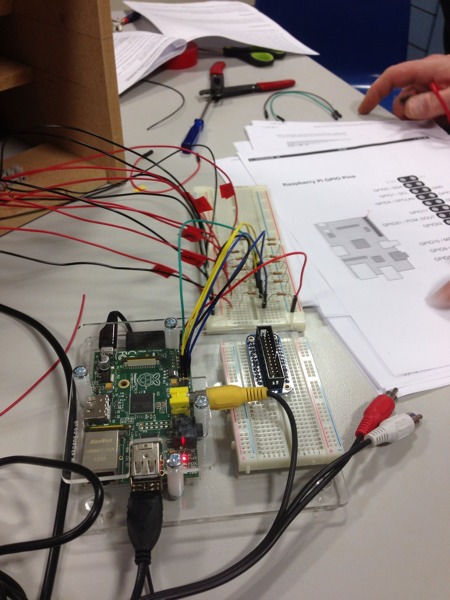

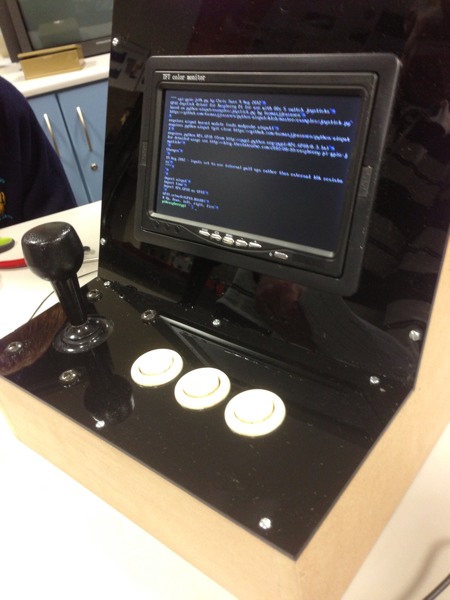

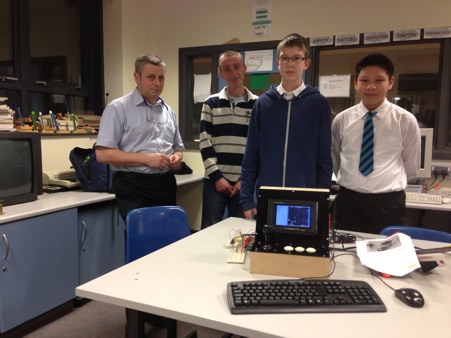

Ingredients: + Case designed and constructed + Electronic bits and bobs (wires, breadboard) + Car reversing monitor screen (with separate power) + Raspberry Pi with 5V power + SD card + Salvaged and donated joystick and buttons Special thanks to Mr Pollock ([Bangor Academy](http://www.bangoracademy.org.uk/) Technology Dept) and Steve Sloan (Momentum/All Island Software Network) for getting … Continue reading “Pi-Cade Project Team at Bangor Academy”

Ingredients:

+ Case designed and constructed

+ Electronic bits and bobs (wires, breadboard)

+ Car reversing monitor screen (with separate power)

+ Raspberry Pi with 5V power

+ SD card

+ Salvaged and donated joystick and buttons

Special thanks to Mr Pollock ([Bangor Academy](http://www.bangoracademy.org.uk/) Technology Dept) and Steve Sloan (Momentum/All Island Software Network) for getting things moving.